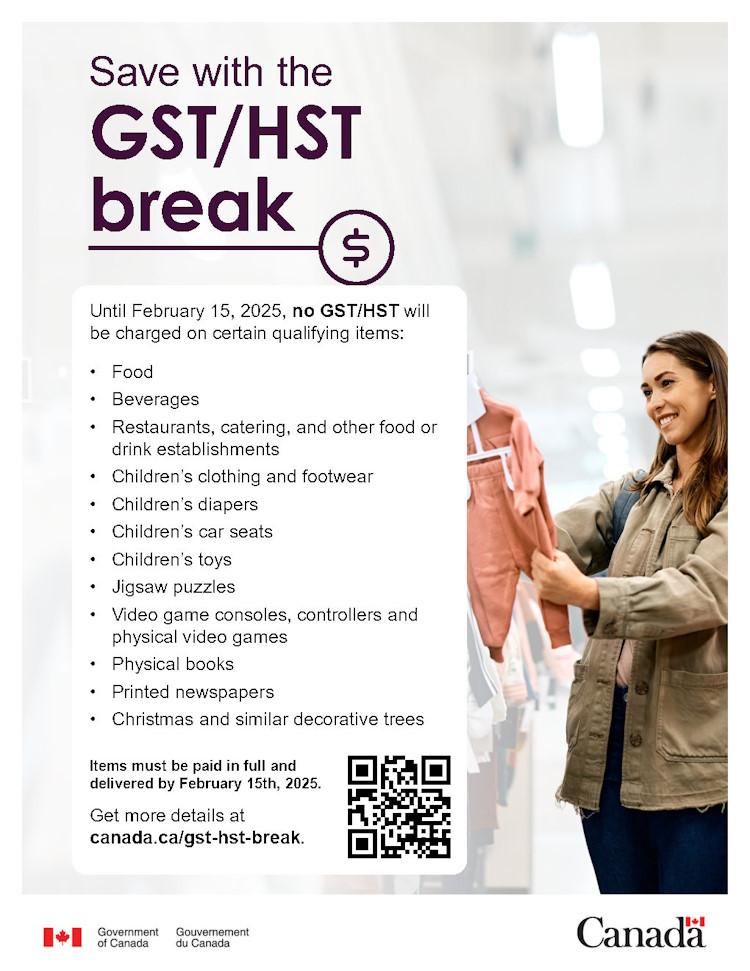

From December 14, 2024, to February 15, 2025, do not charge the GST/HST on the qualifying goods and services listed above.

Keep your records and remit and report your regular GST/HST as usual.

To get important GST/HST break news and industry-specific updates by email, you can sign up for CRA’s stakeholder message electronic mailing list.

Businesses can also contact us with technical GST/HST questions that are not answered here by calling 1-800-959-8287.In detail: zero-rating supplies of the qualifying goods and services

This measure adjusts the Excise Tax Act to temporarily zero-rate supplies of the qualifying goods and services. Zero-rated means that no GST/HST is charged when the supply is made because the tax rate is 0%.

GST/HST registrants can claim an input tax credit for the GST/HST paid or payable on expenses made to provide zero-rated supplies.

Related links

Detailed guidance for restaurants and other eating or drinking establishments

The eligibility of food and beverages during the GST/HST break also applies to food and beverages served at restaurants (and other eating establishments):

Prepared meals

Prepared meals and food, as well as all non-alcoholic beverages and eligible alcoholic beverages qualify for GST/HST relief during the eligible period (December 14, 2024, to February 15, 2025) when they are provided at restaurants, pubs, bars, food trucks, and other establishments that serve food and/or beverages. Cannabis products that are food or beverages do not qualify for GST/HST relief.

Food delivery

When an eating establishment bills a customer directly for delivery of a prepared meal, the delivery service qualifies because it generally has the same tax status as the prepared meal

However, when a delivered prepared meal is ordered through a platform, two separate transactions occur:

- The prepared meal is provided by the eating establishment to the customer

- A delivery service is provided by the platform provider to the customer

The prepared meal provided by the eating establishment to the customer qualifies for GST/HST relief during the eligible period.

The delivery service provided by the platform provider to the customer does not qualify for GST/HST relief.

Orders that include both qualifying and non-qualifying items

GST/HST relief only applies to the qualifying items (prepared meals, non-alcoholic beverages and eligible alcoholic beverages).

When customers order prepared meals or eligible beverages which qualify for GST/HST relief during the eligible period, the GST/HST does not apply on these items.

However, where a customer orders alcoholic beverages which do not qualify for GST/HST relief (such as spirits and liqueurs), the GST/HST still applies on those items.

Cocktails and mixed beverages

Some beverages that are mixed at the establishment for customers (such as cocktails) may also qualify for GST/HST relief.

Mixed drinks that include only eligible beverages such as beer, malt liquor, or wine, qualify for GST/HST relief.

- For example, a mimosa made of sparkling wine and orange juice, or a michelada made of beer and non-alcoholic ingredients would qualify

Mixed drinks that include an alcoholic beverage which does not qualify for GST/HST relief, such as spirits or liqueurs, would not qualify for GST/HST relief.

- For example, a sangria that includes both wine and rum, or a mixed drink such as a vodka and soda, would not qualify

Tips for Prepared Meals

A mandatory tip or gratuity included as part of the bill amount to pay has the same tax status as the prepared meal. This kind of tip qualifies for GST/HST relief for the eligible period.

GST/HST does not apply to a tip or gratuity that is given freely by a customer to an employee of an eating establishment.

Catering

A catering service generally qualifies for GST/HST relief. The catering service must be for the provision, preparation and serving of food, non-alcoholic beverages or eligible alcoholic beverages to qualify.

Other services that do not qualify for GST/HST relief include (but are not limited to):

- Event admission charges

- Facilities hosting fees

- Fees for musicians, disc jockeys or other entertainers

- Chef services where food is prepared and served by a chef but the ingredients to make the meal are not provided by the chef

Make a reasonable effort to comply

Businesses who make reasonable efforts to comply with the legislation will not be the focus of our compliance actions.

We will be focusing on situations where businesses willfully and egregiously refuse to comply with the temporary measures, such as a business that collects the GST/HST and does not remit it to the CRA.