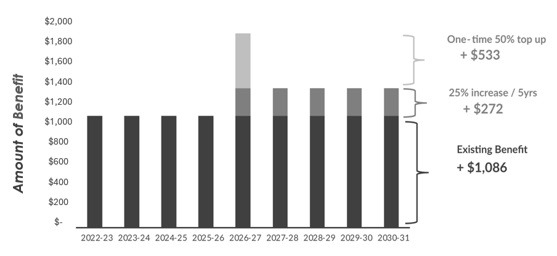

The Canada Groceries and Essentials Benefit, will be indexed to inflation, and builds on the existing Goods and Services Tax (GST) Credit and provide $11.7 billion in additional support over six years by:

- providing a one-time top-up payment to be paid as early as possible this spring and no later than June 2026 (subject to Royal Assent)—equal to a 50% increase in the annual 2025-26 value of the GST Credit. This would deliver $3.1 billion in immediate assistance to individuals and families who currently get the GST Credit.

- increasing the value of the Canada Groceries and Essentials Benefit by 25% for five years starting in July 2026 (subject to Royal Assent). This increase would deliver $8.6 billion in additional support over the 2026-27 to 2030-31 period, including to 500,000 new individuals and families.

Canada Groceries and Essentials Benefit

Benefit amounts are illustrative, and do not reflect price indexation. Benefit years (July-June) are shown and top-up would be paid as early as possible in the spring of 2026 (no later than June, subject to Royal Assent).

Taken together, these measures would provide up to an additional $402 to a single individual without children, $527 to a couple, and $805 to a couple with two children. At these levels, Canada’s new government will be offsetting grocery cost increases beyond overall inflation since the pandemic.

After the one-time payment is made in the spring of 2026 (subject to Royal Assent), eligible families and individuals in Canada will receive the enriched regular payments under the Canada Groceries and Essentials Benefit as of July 2026 (subject to Royal Assent). The benefit will be paid quarterly, at the start of the quarter, to permit timely access to the funds to help families with day-to-day expenses. These amounts are additional to existing benefits such as the Canada Child Benefit, the Canada Disability Benefit, and the Guaranteed Income Supplement.

Under the proposed changes:

- A single senior with $25,000 in net income would receive a one-time top-up of $267 plus a longer-term increase of $136 for the 2026-27 benefit year (total increase of $402). In total, they would receive $950 for the 2026-27 benefit year (including the top-up).

- A couple with two children with $40,000 in net income would receive a one-time top-up of $533 plus an increase of $272 for the 2026-27 benefit year (total increase of $805). In total, they would receive $1,890 for the 2026-27 benefit year (including the top-up).

Family Type |

Maximum Base Amount for 2026-27 | 50% Top-Up | 25% Increase to 2026-27 Amounts | Total Increase 50% Top-Up + 2026-27 benefit year | Total Benefits Received 50% Top-Up + 2026-27 benefit year |

|---|---|---|---|---|---|

| (A) | (B) | (C) | (B) + (C) = (D) | (A) + (D) | |

| Single | $543 | + $267 | +$136 | $402 | $950 |

| Couple, 2 kids | $1,086 | + $533 | + $272 | $805 | $1,890 |

|

*Assuming Royal Assent by March 31, 2026. Numbers may not add up to totals due to rounding. Example for a single individual assumes no children. |

|||||

Enabling legislation for the proposed one-time top-up and further five-year increase to the Canada Groceries and Essentials Benefit will be tabled in the coming weeks. The proposed one-time top-up amount would be paid to all current recipients as a one-time, lump-sum payment as early as possible in the spring of 2026 (no later than June) based on eligibility to the GST Credit in January 2026, pending Parliamentary approval and Royal Assent of enabling legislation. The new Canada Groceries and Essentials Benefit would continue to be delivered quarterly in July, October, January and April.

Recipients would not need to apply for the additional payments, but should file their 2024 tax return if they have not done so already to be able to receive the top-up, and must file their 2025 tax return to receive the increased Canada Groceries and Essentials Benefit payments as of July 2026.

It is estimated that 12.6 million individuals and families would benefit from the new Canada Groceries and Essentials Benefit, representing a material support to Canadians that need it the most, while the government’s plan to build the strongest economy in the G7 takes effect.