Excerpt from CRA Website

Advertising

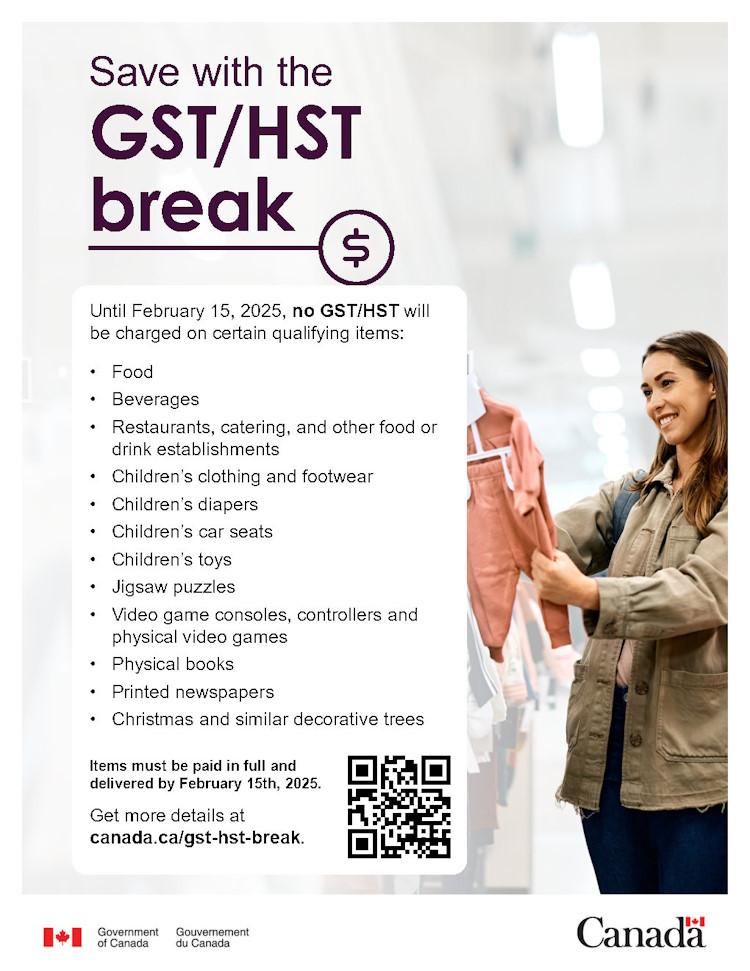

You can deduct expenses for advertising, including advertising in Canadian newspapers and on Canadian television and radio stations. You can also include any amount you paid as a finder’s fee.

To claim the expenses, you must meet certain Canadian content or Canadian ownership requirements. These requirements do not apply if you advertise on foreign websites.

Restrictions apply to the amount of the expense you can deduct for advertising in a periodical:

- You can deduct all the expense if your advertising is directed at a Canadian market and the original editorial content in the issue is 80% or more of the issue’s total non-advertising content.

- You can deduct 50% of the expense if your advertising in a periodical is directed at a Canadian market and the original editorial content in the issue is less than 80% of the issue’s total non-advertising content.

You cannot deduct expenses for advertising directed mainly at a Canadian market when you advertise with a foreign broadcaster.

Allowance on eligible capital property

Note

As of January 1, 2017, the eligible capital property (ECP) system was replaced with the new capital cost allowance (CCA) Class 14.1 with transitional rules. For more information, go to Class 14.1 (5%).

Bad debts

You can generally deduct an amount for a bad debt if:

- you had determined that an account receivable is a bad debt in the year

- you had already included the receivable in income

Business start-up costs

To deduct a business expense, you need to have carried on the business in the fiscal period in which the expense was incurred. You have to be clear about the date your business started.

Where a taxpayer proposes to undertake a business and makes some initial expenditures with that purpose in mind, it is necessary to establish whether the expenditure preceded the start of the business or whether the business had in fact begun and there were expenses incurred during preliminary steps leading to the start of normal operations.

Consequently, the date when the business can be said to have commenced must be known.

Determining what you can claim as a start-up expense can be difficult. For more information, go to Interpretation Bulletin IT-364, Commencement of Business Operations, or see Guide RC4022, General Information for GST/HST Registrants.

Business tax, fees, licences and dues

You can deduct any annual licence fees and some business taxes you incur to run your business.

You can also deduct annual dues or fees to keep your membership in a trade or commercial association, as well as subscriptions to publications.

You cannot deduct club membership dues (including initiation fees) if the main purpose of the club is dining, recreation or sporting activities.

Delivery, freight and express

You can deduct the cost of delivery, freight and express incurred in the year that relates to your business.

You can deduct the cost of fuel (including gasoline, diesel and propane), motor oil and lubricants used in your business.

For information about claiming the fuel used in your motor vehicle, go to Motor vehicle expenses.

The cost of fuel related to business use of workspace in your home has to be claimed as business-use-of-home expenses.

Insurance

You can deduct all ordinary commercial insurance premiums you incur on any buildings, machinery and equipment you use in your business.

The insurance costs related to your motor vehicle have to be claimed as motor vehicle expenses.

The insurance costs related to business use of workspace in your home have to be claimed as business-use-of-home expenses.

In most cases, you cannot deduct your life insurance premiums. However, if you use your life insurance policy as collateral for a loan related to your business, including a fishing business, you may be able to deduct a limited part of the premiums you paid. For more information, go to Interpretation Bulletin IT-309, Premiums on Life Insurance Used as Collateral.

Insurance expenses for fishers

Enter the premiums you paid to insure your fishing boat and equipment.

In most cases, you cannot deduct the amounts you paid to insure personal property such as your home or car. However, if you used the property for personal use and for your fishing business, you can deduct the business part of these costs. For more information, go to Motor vehicle expenses (not including CCA) and Business-use-of-home expenses.

Interest and bank charges

You can deduct interest incurred on money borrowed for business purposes or to acquire property for business purposes. However, there are limits on:

- the interest you can deduct on money you borrow to buy a passenger vehicle or a zero-emission passenger vehicle. For more information, go to Motor vehicle expenses.

- the amount of interest you can deduct for vacant land. Usually, you can only deduct interest up to the amount of income from the land that remains after you deduct all other expenses. You cannot use any remaining amounts of interest to create or increase a loss, and you cannot deduct them from other sources of income.

- the interest you paid on any real estate mortgage you had to earn fishing income. You can deduct the interest, but you cannot deduct the principal part of loan or mortgage payments. Do not deduct interest on money you borrowed for personal purposes or to pay overdue income taxes.

Fees, penalties or bonuses paid for a loan

You can deduct the fee you pay to reduce the interest rate on your loan. You can also deduct any penalty or bonus a financial institution charges you to pay off your loan before it is due. Treat the fee, penalty or bonus as prepaid interest and deduct it over the remaining original term of your loan.

For example, if the term of your loan is five years and in the third year you pay a fee to reduce your interest rate, treat this fee as a prepaid expense and deduct it over the remaining term of the loan. For more information, see Prepaid expenses.

Fees deductible over five years

You can deduct certain fees you incur when you get a loan to buy or improve your business property. These fees include:

- application, appraisal, processing and insurance fees

- loan guarantee fees

- loan brokerage and finder’s fees

- legal fees related to financing

You deduct these fees over a period of five years, regardless of the term of your loan. Deduct 20% (100% divided by five years equals 20%) in the current tax year and 20% in each of the next four years. The 20% limit is reduced proportionally for fiscal periods of less than 12 months.

However, if you repay the loan before the end of the five-year period, you can deduct the remaining financing fees then. The number of years for which you can deduct these fees is not related to the term of your loan.

Fees deductible in the year incurred

If you incur standby charges, guarantee fees, service fees or any other similar fees, you may be able to deduct them in full in the year you incur them. To do so, they have to relate only to that year. For more information, go to Interpretation Bulletin IT-341, Expenses of Issuing or Selling Shares, Units in a Trust, Interests in a Partnership or Syndicate and Expenses of Borrowing Money.

Interest deductible on property no longer used for business purposes

You may be able to deduct interest expenses for a property you used for business purposes, even if you have stopped using the property for such purposes because you are no longer in business. For more information, go to Income Tax Folio S3-F6-C1, Interest Deductibility.

Interest on loans made against insurance policies

You can deduct interest you paid on a loan made against an insurance policy, as long as the insurer didn’t add the interest you paid to the adjusted cost base of the insurance policy. To claim the interest you paid for the year, have the insurer verify the interest before June 16 of the following year on Form T2210, Verification of Policy Loan Interest by the Insurer.

Capitalizing interest

You can choose to capitalize interest on money you borrow either:

- to buy depreciable property

- to buy a resource property

- for exploration and development

When you choose to capitalize interest, add the interest to the cost of the property or exploration and development costs instead of deducting the interest as an expense.

Interest related to workspace in your home

The interest related to business use of workspace in your home has to be claimed as business-use-of-home expenses.

Legal, accounting and other professional fees

You can deduct the fees you incurred for external professional advice or services, including consulting fees.

You can deduct accounting and legal fees you incur to get advice and help with keeping your records. You can also deduct fees you incur for preparing and filing your income tax and GST/HST returns.

You can deduct accounting or legal fees you paid to have an objection or appeal prepared against an assessment for income tax, Canada Pension Plan or Quebec Pension Plan contributions, or employment insurance premiums. However, the full amount of these deductible fees must first be reduced by any reimbursement of these fees that you have received. Enter the difference on line 23200, Other deductions, of your income tax return (line 23200 was line 232 before tax year 2019).

If you received a reimbursement in the tax year, for the types of fees that you deducted in a previous year, report the amount you received on line 13000, Other income, of your income tax return of the current year (line 13000 was line 130 before tax year 2019).

You cannot deduct legal and other fees you incur to buy a capital property, such as a boat or fishing material. Instead, add these fees to the cost of the property. For more information on capital property, go to Claiming capital cost allowance (CCA).

For more information, go to Interpretation Bulletin IT-99, Legal and Accounting Fees.

Maintenance and repairs

You can deduct the cost of labour and materials for any minor repairs or maintenance done to property you use to earn business income.

However, you cannot deduct any of the following:

- the value of your own labour

- the costs you incur for repairs that are capital in nature (capital expense)

- the costs you incur for repairs that have been reimbursed by your insurance company

For repairs that are capital in nature, you can claim a capital cost allowance.

You have to claim the maintenance and repairs related to business use of workspace in your home as business-use-of-home expenses.

Note for daycares

You can only deduct maintenance and repair expenses if you can prove that the day to day running of your daycare is what caused any damage and you have not received any compensation or refund from your insurer.

Management and administration fees

You can deduct management and administration fees, including bank charges, incurred to operate your business. Bank charges include those for processing payments.

Do not include:

Instead, report these amounts separately.

Meals and entertainment (allowable part only)

The maximum amount you can claim for food, beverages and entertainment expenses is 50% of the lesser of the following amounts:

- the amount you incurred for the expenses

- an amount that is reasonable in the circumstances

These limits also apply to the cost of your meals when you travel or go to a convention, conference or similar event. However, special rules can affect your claim for meals in these cases. For more information, see Travel.

These limits do not apply if any of the following apply:

- Your business regularly provides food, beverages or entertainment to customers for compensation (for example, a restaurant, hotel or motel).

- You bill your client or customer for the meal and entertainment costs, and you show these costs on the bill.

- You include the amount of the meal and entertainment expenses in an employee’s income or would include them if the employee did not work at a remote or special work location. In addition, the amount cannot be paid or payable for a conference, convention, seminar or similar event and the special work location must be at least 30 kilometres from the closest urban centre with a population of 40,000 or more. For more information about urban centres, go to Statistics Canada’s Population and Dwelling Count Highlight Tables.

- You incur meal and entertainment expenses for an office party or similar event, and you invite all your employees from a particular location. The limit is six such events per year.

- You incur meal and entertainment expenses for a fund-raising event that was mainly for the benefit of a registered charity.

- You provide meals to an employee housed at a temporary work camp constructed or installed specifically to provide meals and accommodation to employees working at a construction site (note that the employee cannot be expected to return home daily).

Entertainment expenses include tickets and entrance fees to an entertainment or sporting event, gratuities, cover charges, and room rentals such as hospitality suites. For more information, go to Interpretation Bulletin IT-518, Food, Beverages and Entertainment Expenses.

Meals and entertainment expenses for fishers

Claim the total amount you paid for food you stocked on your boat to feed your crew when you fished offshore.

Often, inshore fishers do not stock food. Instead, they bring meals from home for their crew because the trips are short (leave home early in the morning and come back late in the afternoon). You can deduct the cost of these meals as long as the meals were a taxable benefit to your crew.

In some cases, you can deduct the cost of meals even though they were not taxable benefits. You can do this if your boat was at sea for 36 hours or more and the meals you provided for your crew were not taxable benefits. Also, if you gave meals to your sharespeople, generally the meals you provided for them are not taxable benefits because we do not consider sharespeople to be employees. The 50% rule applies to all self-employed sharespeople. However, they may be limited by the restriction noted above.

For more information about taxable benefits, see the T4130, Employers’ Guide – Taxable Benefits and Allowances.

Long-haul truck drivers

Expenses for food and beverages consumed by a long-haul truck driver during an eligible travel period are deductible at 80%.

An eligible travel period is a period of at least 24 continuous hours throughout which the driver is away from the municipality and metropolitan area that he or she resides in (the residential location) and is driving a long-haul truck that transports goods to or from a location that is beyond a radius of at least 160 kilometres from the residential location.

Extra food and beverages consumed by self-employed

This information is for self-employed:

- on foot

- bicycle couriers

- rickshaw drivers

They can deduct the cost of the extra food and beverages they must consume in a normal working day (eight hours) because of the nature of their work.

The daily flat rate that can be claimed is $23.

If you are claiming this deduction you should be prepared to provide logbooks showing the days worked and the hours worked on each of these days during the tax year. The CRA may also ask for dispatch slips or other documents to support the days worked during the tax year.

By using this flat-rate deduction, you will not be required to maintain or submit receipts for the extra meal and beverage consumed.

If you want to claim more than the flat-rate amount, the CRA will also need:

- supporting receipts for all food and beverages claimed

- something that clearly shows the extra amount of food and beverages required because of the nature of your work, and how this amount exceeds what the average person would consume in terms of both cost and quantity

Office expenses

You can deduct the cost of office expenses. These include small items such as:

- pens

- pencils

- paper clips

- stationery

- stamps

Office expenses do not include items such as:

- calculators

- filing cabinets

- chairs

- desks

These are capital items.

Prepaid expenses

A prepaid expense is an expense you pay ahead of time. Under the accrual method of accounting, claim any expense you prepay in the year or years in which you get the related benefit.

Example

Suppose your fiscal year-end is December 31, 2021. On June 30, 2021, you prepay the rent on your store for a full year (July 1, 2021, to June 30, 2022). You can only deduct one-half of this rent as an expense in 2021. You deduct the other half as an expense in 2022.

Under the cash method of accounting, you can’t deduct a prepaid expense amount (other than for inventory) relating to a tax year that is two or more years after the year the expense is paid.

However, you can deduct the part of an amount you paid in a previous year for benefits received in the current tax year. You can deduct these amount as long as you have not previously deducted them.

Example

If you paid $600 for a three-year service contract for office equipment in 2021, you can deduct $400 in 2021. This represents the part of the expense that applies to 2021 and 2022. On your 2023 income tax return, you could then deduct the balance of $200 for the part of the prepaid lease that applies to 2023.

For more information, go to Interpretation Bulletin IT-417, Prepaid Expenses and Deferred Charges.

Property taxes

You can deduct property taxes you incurred for property used in your business. For example, you can deduct property taxes for the land and building where your business is situated.

The property tax related to business use of workspace in your home has to be claimed as business-use-of-home expenses.

Rent

You can deduct rent incurred for property used in your business. For example, you can deduct rent for the land and building where your business is situated.

The rent expense related to business use of workspace in your home has to be claimed as business-use-of-home expenses.

Salaries, wages and benefits (including employer’s contributions)

Ask for a CPP/EI ruling on employment status

If you or a person working for you is not sure of the worker’s employment status (employee or self-employed), either of you can ask the CRA for a CPP/EI ruling to have the status determined and whether the employment is pensionable, insurable, or both. The ruling can also determine if the earnings are pensionable, insurable, or both. For more information, go to How to get a CPP/EI ruling.

For information on employment status, go to Canada Pension Plan and Employment Insurance Rulings and see Guide RC4110, Employee or Self-Employed?

Amounts you can deduct as an employer

You can deduct gross salaries and other benefits you pay to employees.

Do not include:

- salaries and wages such as direct wage costs or subcontracts

- drawings of the owners of the business

- salaries or drawings of the owners of the business since salaries or drawings paid or payable to you or your partners are not deductible

The Canada Pension Plan is for all workers, including the self-employed. Employers, employees and most self-employed individuals must contribute to the CPP. The CPP can provide basic benefits when you retire or if you become disabled. When you die, the CPP can provide benefits to your surviving spouse or common-law partner and your dependent children under 25. For more information on contribution and benefits, visit Service Canada.

Quebec workers including the self-employed are covered under the Quebec Pension Plan.

As the employer, you can deduct your part of the following amounts payable on employees’ remuneration:

- CPP or QPP contributions

- employment insurance (EI) premiums

- Provincial parental insurance plan premiums, which is an income replacement plan for residents of Quebec (visit Revenu Québec for details)

- workers’ compensation amounts for your employees

You report each salary by the end of February on a T4 slip, Statement of Remuneration Paid, or T4A slip, Statement of Pension, Retirement, Annuity and Other Income.

You can also deduct any premiums you pay for an employee for a sickness, an accident, a disability or an income insurance plan. For more information on these slips, see T4001, Employer’s Guide – Payroll Deductions and Remittances, and go to Payroll.

You can deduct the salary you pay to your child, as long as you meet all these conditions:

- you pay the salary

- the work your child does is necessary for earning business, professional or fishing income

- the salary is reasonable when you consider your child’s age, and the amount you pay is what you would pay someone else

Keep documents to support the salary you pay your child. If you pay your child by cheque, keep the cancelled cheque. If you pay cash, have the child sign a receipt.

Instead of cash, you can pay your child with a product from your business. When you do this, claim the value of the product as an expense and add to your gross sales an amount equal to the value of the product. Your child has to include the value of the product in his or her income.

You can also deduct the salary you pay to your spouse or common-law partner. When you pay your spouse or common-law partner a salary, use the same rules that apply to paying your child.

Report the salaries you pay to your children and spouse or common-law partner on T4 slips, the same as you would for other employees. However, you cannot claim as an expense the value of board and lodging you provide to your dependent children and your spouse or common-law partner.

For more information, see Guide RC4120, Employers’ Guide – Filing the T4 Slip and Summary.

Supplies

You can deduct the cost of items the business used indirectly to provide goods or services (for example, drugs and medication used in a veterinary operation, or cleaning supplies used by a plumber).

Telephone and utilities

You can deduct expenses for telephone and utilities, such as gas, oil, electricity, water and cable, if you incurred the expenses to earn income.

The expenses for utilities that are related to business use of workspace in your home have to be claimed as business-use-of-home expenses.

Travel

You can deduct travel expenses you incur to earn business and professional income. Travel expenses include:

- public transportation fares

- hotel accommodations

- meals

In most cases, the 50% limit applies to the cost of meals, beverages and entertainment when you travel. For more information, see Meals and entertainment (allowable part only).

The 50% limit also applies to the cost of food and beverages served and entertainment enjoyed when you travel on an airplane, train or bus, when the ticket price does not include such amounts.

Forms and publications